The Opportunity in Bitcoin Finance

Unlocking a billion dollar BTC trade

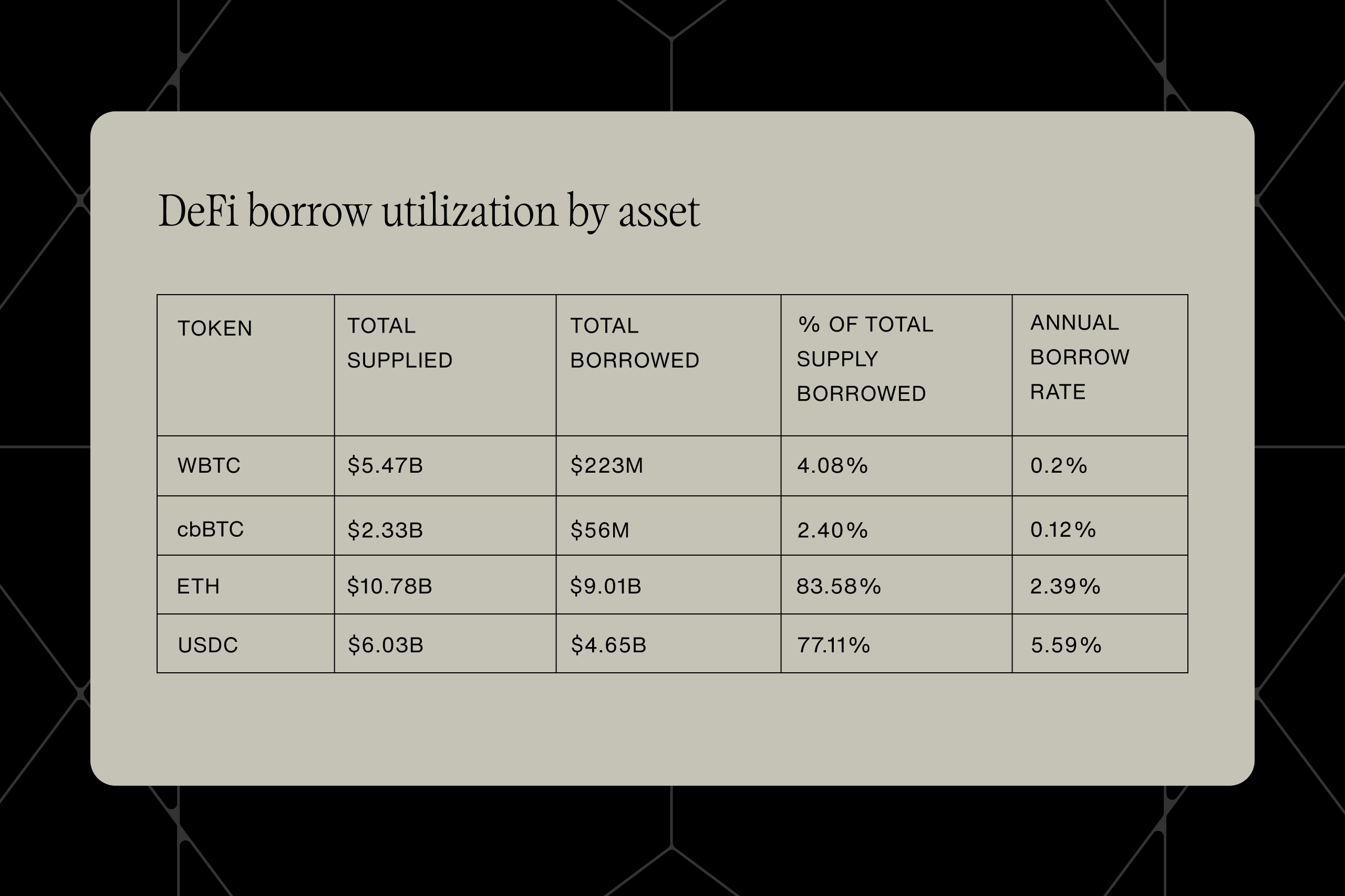

Of the ~$8B of BTC on AAVE’s Ethereum deployment, only about $250m is being borrowed at an annual rate of less than 0.25%. This contrasts other tokens like ETH and USDC whose utilizations, borrow rates, and lending yields are much higher.

These numbers tell us a few things :

- Given the low rates, the primary use case for BTC is collateral for borrowing

- There is little demand to borrow BTC

- Short sellers are better off using perpetual futures where they get paid to short

- There is not a significant market for rates arbitrage on BTC, where people borrow at low rates and earn at higher ones

Let’s dive into these points a bit deeper.

Borrow looping

The two markets driving most of the TVL growth in onchain finance this cycle are yield bearing tokens (Ethena, EtherFi, Lombard…) and lend-borrow markets (Morpho, AAVE, Euler,...). And their growth is highly interconnected.

Borrow looping - the act of borrowing at a lower rate, swapping the tokens for a yield bearing token earning a higher rate, providing that as collateral to borrow again, and repeating - has driven billions of dollars of capital into lend-borrow markets and yield bearing tokens. The increase in borrow activity from looping drives returns to lenders who earn the rate that loopers pay to leverage their position. As a result, lending becomes a way to earn lower yields at lower risks, as they have the added benefit of being protected against drawdowns (e.g., slashing or depegs).

Ethereum had a unique advantage in growing its lend-borrow activity since lending was introduced before staking. The same can not be said about other ecosystems, namely those which launched alongside staking. Naturally, since early on lending was the primary source of low risk yields for depositors, ETH lending supply built up. When staking launched, and tokenized staking yield made it easy to use a staking position as collateral, users were able to take advantage of the glut of lending supply that had built up and borrow ETH cheaply against their Lido wstETH to leverage the returns via looping.

A similar opportunity exists today for BTC yield products. This is because the growth of lending supply has preceded the proliferation of yield bearing BTC. All that’s needed is a yield bearing BTC that can be used as collateral.

The current market

BTC yield tokens have only recently begun to take off with the launch of Babylon (Bitcoin staking) and the protocols that are tokenizing staking positions on Babylon (e.g., Lombard, EtherFi, Bedrock). The yield source for these tokens are token inflation and/or points.

This makes it difficult for these tokens to autocompound - as doing so requires them to sell the token rewards for Bitcoin or find ways to sell their points before they materialize¹. And the lack of autocompounding makes them difficult to loop, as margin maintenance becomes more complicated when you need to claim rewards, swap them for the collateral asset and deposit into your account manually. We can see these frictions play out empirically by just looking at LBTC’s AAVE listing which has failed to make a significant dent in BTC lending.

¹ One way to achieve compounding yield on a points or incentive driven derivative is to use a fixed rate protocol like Pendle, and use the PT for collateral. Notably this has become very popular for USDe, although the same has not happened for BTC yield. Some potential reasons for this include: low yields, high churn from maturing collateral, differences in go-to-market timing or strategy.

The opportunity

What’s needed for this market to take off is a scalable, autocompounding, yield-bearing BTC token.

As we previously mentioned, autocompounding is one part of unlocking the borrow-looping trade on BTC as it removes complexity from margin maintenance and risk from point-value speculation.

Scalability is the other. Unlike ETH and USD which have practically infinite supply for yield (via staking or treasuries respectively), BTC has no natural source of scalable yield since it’s secured by proof-of-work. This friction explains why we have yet to see sustainable, scalable yield bearing BTC tokens proliferate in the onchain economy and instead yield primarily driven by token inflation and speculative points programs. Scalability is also a critical component in making it possible to bootstrap enough liquidity for safe and significant collateral supply capacity for a single token denomination.

This is not to say that it’s impossible to create one. Over the last few years futures markets on crypto tokens have become increasingly liquid. As a result, market participants are able to hedge large scale portfolios of crypto tokens at lower costs than ever - which has given way to the burgeoning structured product industry onchain.

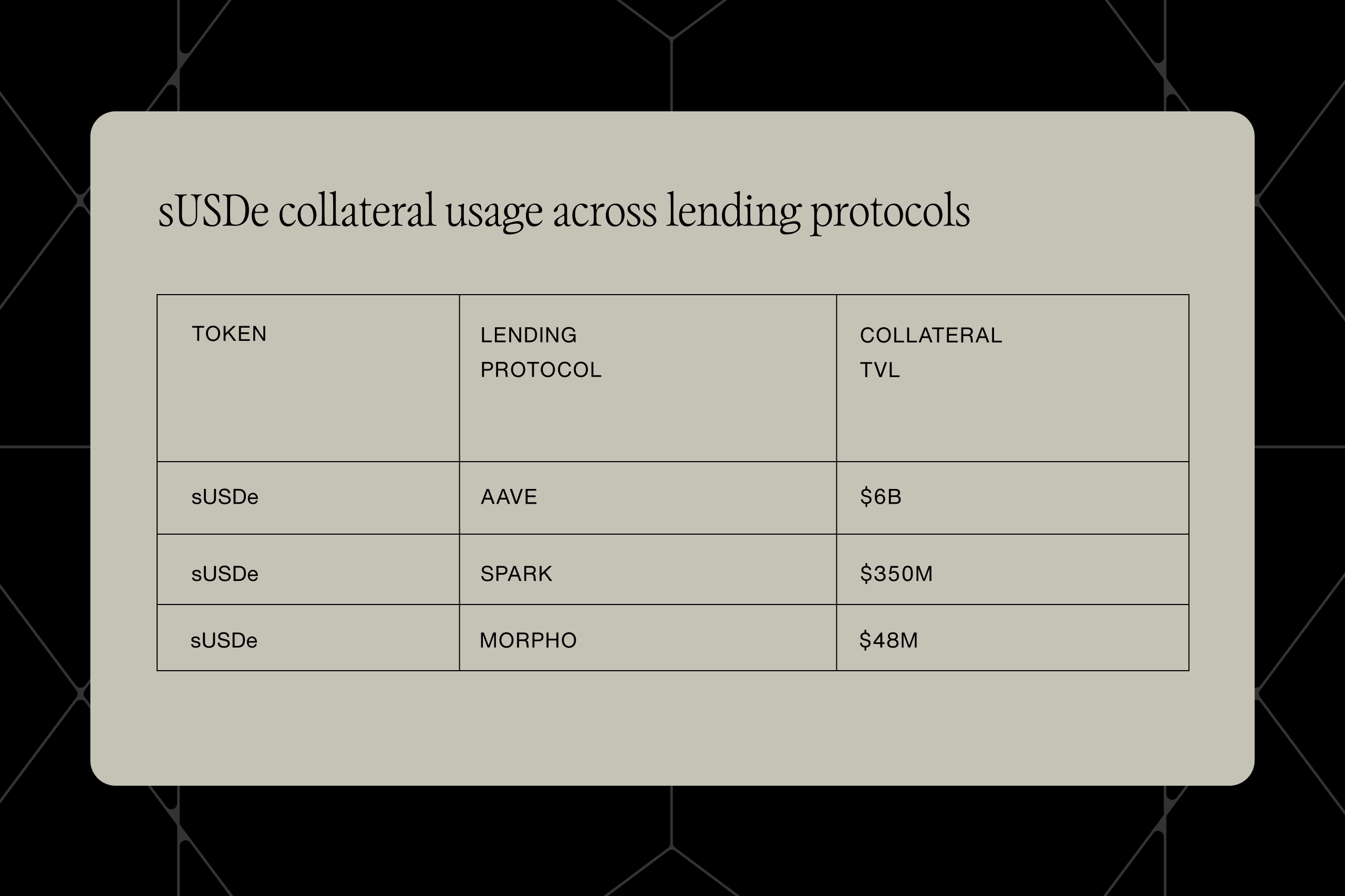

We are seeing this play out with Ethena, which at the time of writing this has garnered $15B in TVL. Ethena holds spot assets like BTC, ETH or wstETH and shorts them on perpetual futures exchanges to hedge into a delta-neutral position (i.e., the position’s PnL is not exposed to fluctuations in price of their spot holdings). Since futures markets are typically in Contango (i.e., shorts get paid by longs), the position earns fees paid from long traders. After tokenizing these positions, they allow a yield bearing, dollar denominated token to be composable with the rest of the onchain economy. Unsurprisingly much of their growth is being driven by using the receipt token (sUSDe) as collateral in onchain lending protocols.

This same catalyst (liquid crypto futures markets) that made dollar-denominated, yield bearing tokens like Ethena possible, also opens the possibility for BTC-denominated, yield bearing tokens.

Conclusion

Much of the growth in yield bearing tokens (e.g., sUSDe, wstETH, weETH) has been driven by collateral usage, particularly borrow-looping. If we consider the three major crypto denominations USD stablecoins, ETH and BTC, only BTC related finance has been left out of this growth despite abundant lending supply. The reason is straightforward: borrow-looping requires a collateral asset that compounds faster than the borrow costs, and no such BTC denominated token meets this requirement.

For this to change, there needs to be a scalable, autocompounding, yield-bearing BTC token.

- Scalability is important because it means the token can support enough deposits to saturate borrow-looping demand and enough liquidity to safely increase collateral capacity.

- Autocompounding is important because it allows loopers to minimize their margin maintenance overhead.

The difficulty in doing so is largely tied to there being no natural, scalable source of yield on BTC, whereas USD and ETH have treasuries and native staking. One catalyst that may change this has been the growth of liquid futures markets which can be used to hedge positions. This has enabled protocols like Ethena to create USD denominated positions earning above the risk free rate, and could be extended to enable non-USD denominated yield bearing tokens as well.

To see how this thesis is applied in practice, read Introducing maxBTC: real yield on Bitcoin.

About Structured

Structured is shaping a new standard for Bitcoin yield, turning BTC from a static store of value into a liquid asset that generates sustainable returns and unlocks broader financial utility. Its mission is to deliver real BTC yield that’s scalable, composable, and liquid by design.

The team draws on deep expertise from leading liquid staking protocols and institutional staking providers. We build on proven DeFi infrastructure to create yield solutions designed specifically for Bitcoin’s unique characteristics and structural realities.

During our contributors’ time at Lido (Ethereum’s leading liquid staking provider), P2P (an institutional staking provider), and Nomura (Japan’s largest investment bank and brokerage), we developed a deep, first-hand understanding of what it takes to make the largest crypto assets liquid, secure, and impactful within an open financial ecosystem.

- Follow Structured on Twitter and LinkedIn

- Join the announcement channel on Telegram

- Get in touch with the team

Comments ()