Setting the collateral-readiness standard for liquid strategy tokens

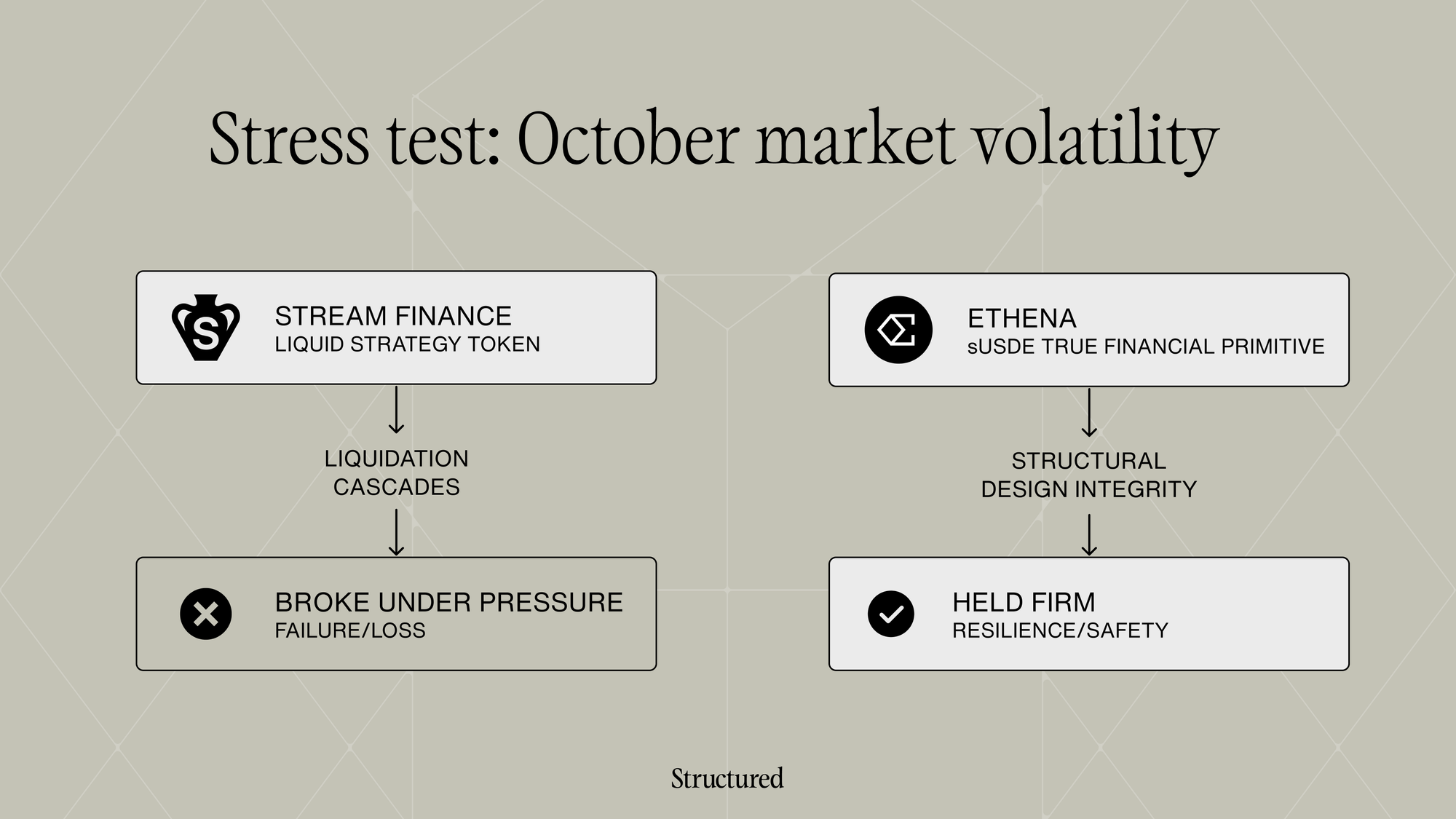

In October, a market stress test showed that theory and practice are not always the same. Stream Protocol's liquid strategy token failed under pressure. Ethena's sUSDe did not. Both tokens offered yield and composability, but only one survived the liquidations. The reason was in their design.

This event made it clear that not all liquid strategy tokens are equal. The difference between a vault receipt and a real financial building block can decide whether you stay safe or lose everything in a volatile market.

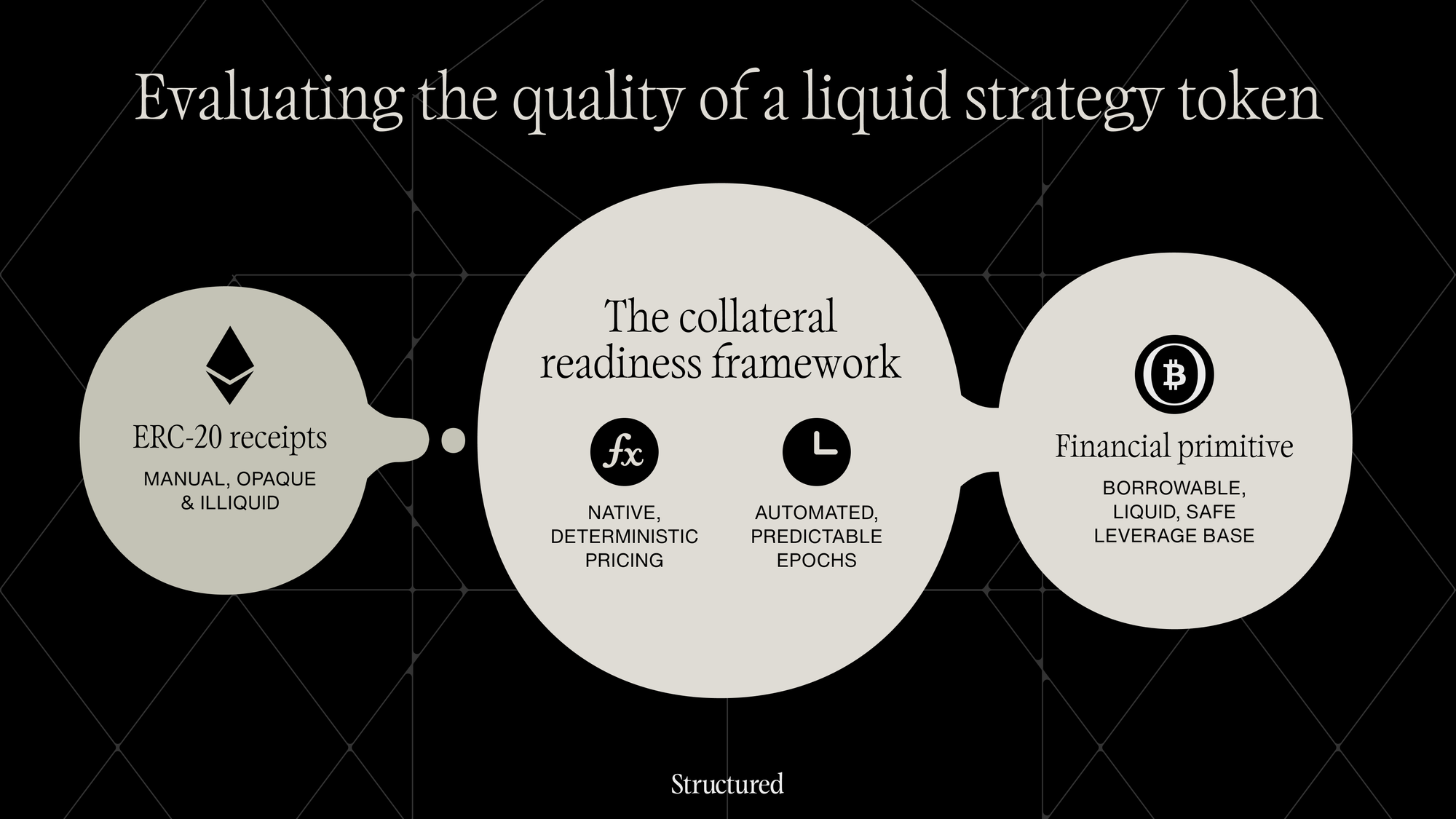

In DeFi, people often confuse technical compatibility, like the ERC-20 standard, with real financial utility or moneyness. For experienced investors, a liquid strategy token (LST) is just a proof-of-deposit receipt until it proves it can be trusted as collateral.

Schlagonia from Yearn recently argued that the industry needs clearer standards, transparency, and stronger due diligence. This concern extends beyond individual incidents. Research from Redstone shows that yield-bearing assets are often compared using surface-level metrics, even though meaningful comparisons require understanding their underlying risks. Headline numbers like APY or TVL can obscure structural differences that only become visible under stress.

Collateral readiness is the standard that determines whether an LST can unlock true capital efficiency through leverage. We touched on this in our earlier article on the opportunity in Bitcoin finance.

An ERC-20 token can work in decentralized exchanges, but real financial composability needs more than code. It needs moneyness. An asset is only liquid and useful if it can be borrowed against. If a lending desk cannot price an asset accurately or guarantee a quick exit in a crisis, that asset has no collateral value, no matter its technical standard.

A strategy token only moves from being a proof of deposit to a true financial primitive when it is ready to be used as collateral. Serving as collateral is the main test of a financial asset’s strength. This is what unlocks leverage and allows capital to be reused.

Lending protocols need to manage insolvency risk in real time. They must be able to liquidate collateral instantly if a borrower’s health factor drops. Any delay in pricing or selling the asset makes it unfit as collateral.

An LST must meet two requirements to work as collateral: deterministic pricing and deterministic exit. If either fails, the token cannot be used reliably in financial systems.

How to determine the quality of an LST

1. The price gatekeeper: valuation determinism

In traditional markets, measuring Net Asset Value (NAV) can sometimes be an end-of-day, or even end-of-month, process based on opaque marks, while in DeFi, collateral must be priced on-chain and in real time because lending protocols rely on on-chain oracles to trigger liquidations block by block. For that to work, an LST needs a valuation method that is native to the chain and fully deterministic.

Lending protocols rely on on-chain Oracles to trigger liquidations block-by-block. Therefore, an LST must have a native, deterministic valuation standard.

- Requirement: Can the token's fair value be calculated entirely on-chain, mathematically, at any given block, without human input?

- The implication: If a strategy is a black box that reports NAV from a centralized server rather than deriving it from on-chain assets, it introduces oracle risk. Lending protocols cannot safely list assets with ambiguous or manipulatable pricing feeds. If pricing is not deterministic, the asset cannot be treated as reliable collateral.

2. The time gatekeeper: duration determinism

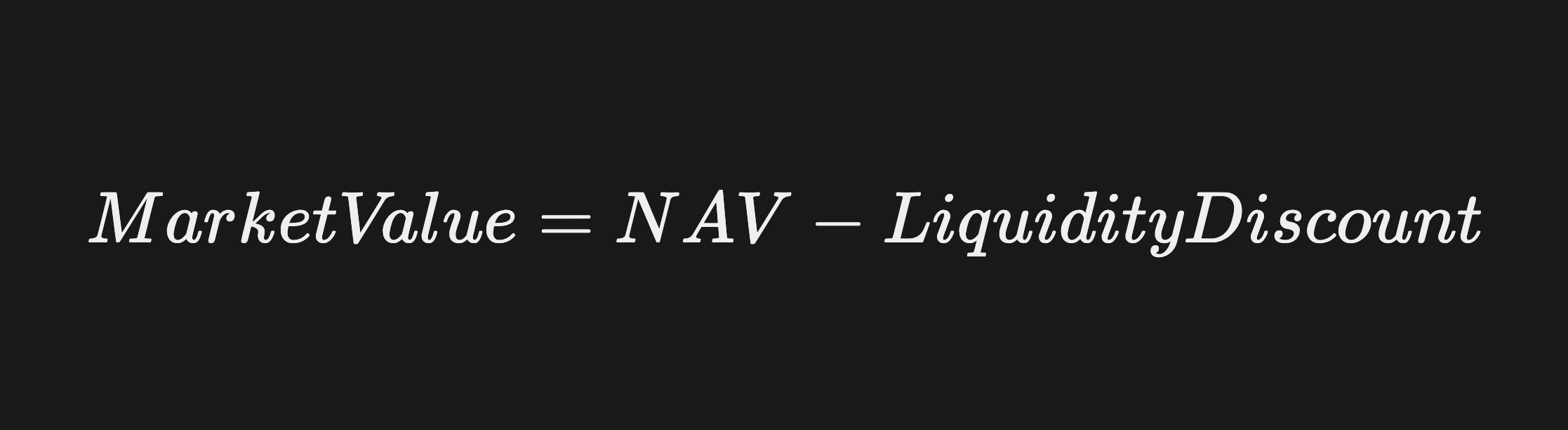

The second, often overlooked, friction is duration risk, which is how sensitive an asset’s value is to the time required to convert it back to cash. In DeFi, this can be expressed as:

When withdrawal timelines are uncertain, the liquidity discount spikes toward infinity during a crisis. To minimize this discount, the redemption process must be fully automated and predictable.

- True automation (epochs)

Withdrawals are processed through predictable, contract-enforced windows (for example, every 4 hours). The timeline is code-guaranteed. - False automation (scheduled)

Many protocols claim automation but rely on "scheduled" withdrawals, such as processing every Friday. This approach requires human batching and multisig approvals. - Implication

Scheduled processes introduce operational duration risk, the risk that the human operator is unavailable, incapable, or unwilling to process redemptions during extreme market volatility. For collateral, this risk is untradeable.

Deep auditing of every protocol is often impractical, even for professionals. Fortunately, fake composability reveals itself through operational patterns that are easy to spot without going through the code.

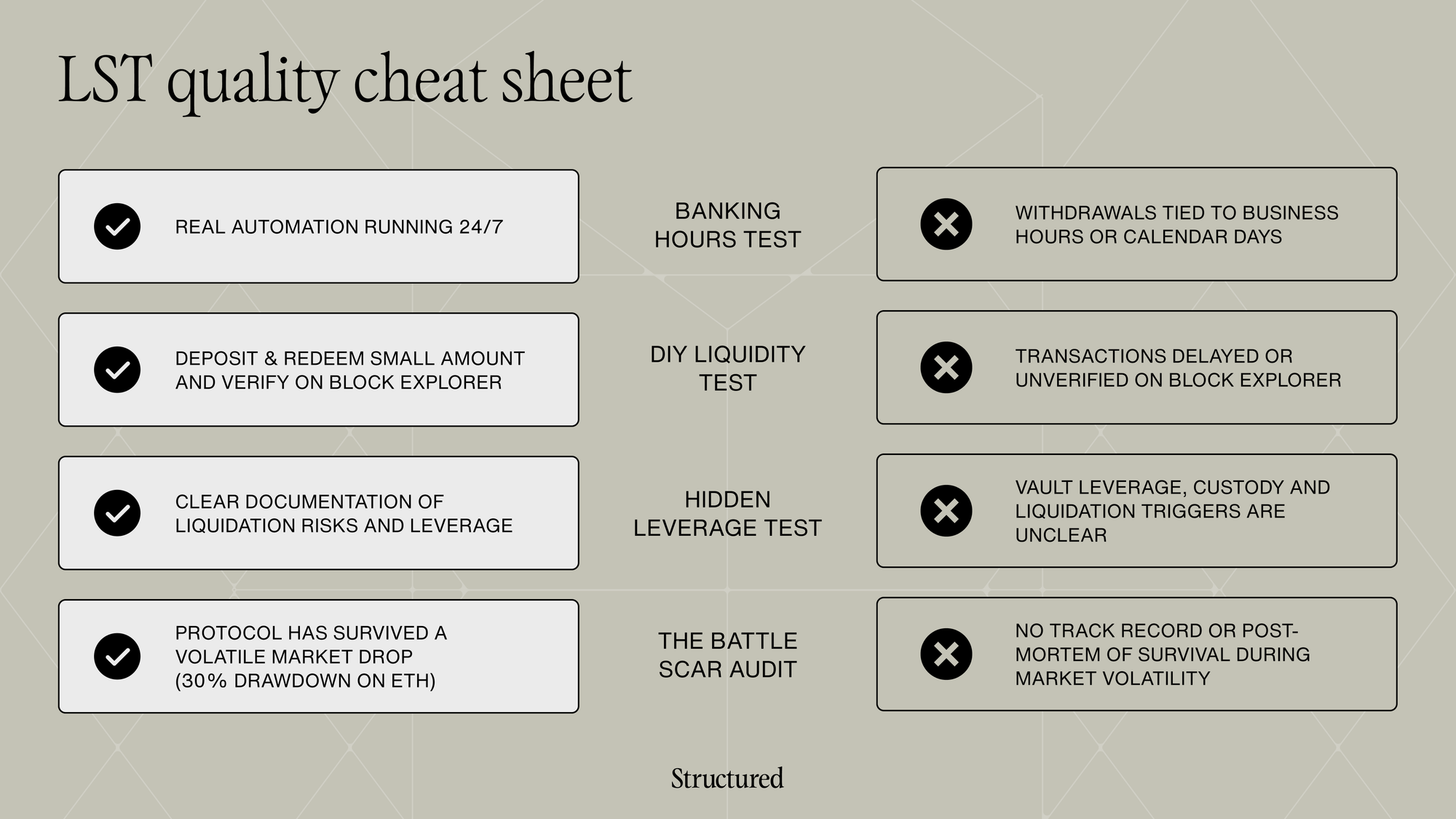

How to tell if an LST is collateral-ready

1. The banking hours test (automation vs manual)

A red flag is withdrawals that are processed only during business hours or on fixed calendar days, such as 9 to 5 EST or every Friday.If withdrawals only move when people are online, the protocol still depends on manual work. For collateral assets, this is a problem because liquidity must function during market swings, not just office hours. The banking hours test shows whether the system is actually automated or still needs people to run.

2. The DIY liquidity test (verification)

A red flag is when documentation promises instant liquidity but chain data shows gaps or delays.To verify how the protocol behaves:

- Check chain data: review the contract on Etherscan. Do redemptions settle on time.

- Do the $10 test: deposit a small amount and try to redeem it immediately. If the process is slow or unreliable for $10, it will not scale to $10 million.

- Check proof of reserves: look for a live, on-chain dashboard that confirms assets exist. Without it, you are trusting a spreadsheet.

3. The hidden leverage test

A red flag is uncertainty about the vault’s leverage level or the conditions that trigger liquidation.Leverage inside the vault compounds with leverage taken against the token. A vault running 3x leverage plus another 3x borrowed against the token is not 3x exposure, it is 9x.Understanding the kill-switch price and liquidation logic is essential for lenders to model real risk. If this is unclear, the true risk surface cannot be priced.

4. The battle-scar audit (history and edge cases)

The red flag here is a protocol that has never been tested during an actual market stress event, such as a 30 percent drawdown in a core asset within a single day.Calm markets can hide deeper problems. Allocators should look at demonstrated resilience, not theoretical design.

- Edge cases: did the peg hold during volatility? Did redemptions continue or pause?

- Post-mortems: if incidents occurred, were mechanisms rebuilt or just patched?

Conclusion

For allocators, the ability to distinguish true primitives from advanced receipts is essential to deploy capital effectively in DeFi.The transition from a receipt to a true primitive depends on collateral readiness, which requires two conditions:

- Price determinism: the token’s value can be determined on-chain in real time without human input.

- Time determinism: redemptions run through automated and predictable time windows.

Without both structural properties, the token remains uncomposable, unable to support leverage or function as reliable collateral in DeFi lending markets.

About Structured

Structured is shaping a new standard for Bitcoin yield, turning BTC from a static store of value into a liquid asset that generates sustainable returns and unlocks broader financial utility. Its mission is to deliver real BTC yield that’s scalable, composable, and liquid by design.

The team draws on deep expertise from leading liquid staking protocols and institutional staking providers. We build on proven DeFi infrastructure to create yield solutions designed specifically for Bitcoin’s unique characteristics and structural realities.

During our contributors’ time at Lido (Ethereum’s leading liquid staking provider), P2P (an institutional staking provider), and Nomura (Japan’s largest investment bank and brokerage), we developed a deep, first-hand understanding of what it takes to make the largest crypto assets liquid, secure, and impactful within an open financial ecosystem.

- Follow Structured on Twitter and LinkedIn

- Join the announcement channel on Telegram

- Get in touch with the team

Comments ()