maxBTC vaults on Neutron

Structured is opening up access to maxBTC with two vaults on Neutron as part of Phase 1 of the Bitcoin Summer campaign.

Guide: maxBTC vaults on Neutron

Structured is opening up access to maxBTC on Neutron as part of Phase 1 of Neutron’s Bitcoin Summer campaign. This phase introduces a dedicated vault that allow participants to mint maxBTC and earn BTC-denominated yield ahead of the full protocol launch.

maxBTC allows Bitcoin to act as productive capital through scalable and market-neutral strategies. It preserves BTC exposure while compounding returns in a liquid, composable format. For the broader vision and thesis, see Introducing maxBTC: Real Yield on Bitcoin.

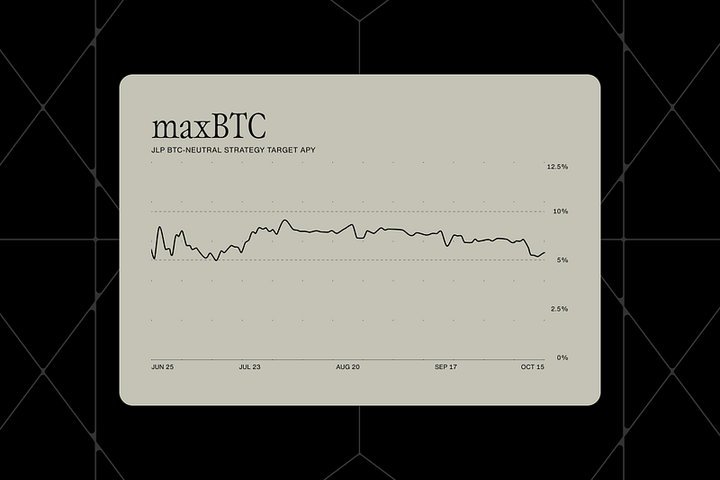

Structured’s first strategy is based on the Jupiter Liquidity Provider (JLP) pool, which backs leveraged positions on Jupiter Perps and earns fees from trader activity. It has been live for more than 250 days and, since June, private beta deposits have delivered 5-10% BTC-denominated APY without inflationary token incentives. For mechanics and performance, see maxBTC Explained: JLP Strategy.

Vault Open for Deposits

The maxBTC Minting vault is open for deposits on Neutron. Deposits are capped at 500 BTC. The vault accepts WBTC, wrapped Bitcoin on Ethereum mainnet to mint maxBTC. It connects directly to Structured’s minting contracts, and the underlying strategy is deployed once the cap is reached.

Withdrawals are possible at any time. When withdrawing, depositors receive maxBTC on Neutron at their designated address.

maxBTC Minting Vault

For holders who want straightforward exposure to maxBTC without additional incentives. Users deposit WBTC, mint maxBTC, and enter the queue until batch deployment. Once the 500 BTC deposit cap is reached, funds are deployed into Structured’s BTC-neutral JLP strategy. No strategy yield accrues during the queueing period — yield begins only after deployment.

How it works:

- Go to structured.money/vaults and select the maxBTC Minting Vault

- Connect an Ethereum wallet

- Follow the steps to complete KYC via third-party provider zkMe

- Deposit WBTC from Ethereum into the maxBTC Minting Vault

- Deposits queue until the 500 BTC cap is hit

- At fund deployment depositors earn sustainable real BTC yield via maxBTC

Structured Points Program

The Structured Points Program recognizes early participation across vaults and integrations. Points start accruing from day one and will appear retroactively once the leaderboard is live, with weekly updates.

For details, see our FAQ and structured.money/points.

Participants depositing into the Minting vault will also receive NTRN rewards. See Bitcoin Summer and the Bitcoin Summer rewards system for details.

Participation requirements

Structured, its partners and affiliates comply with applicable AML laws and regulations. All participants must complete KYC to mint maxBTC and otherwise participate in this phase and access the vaults.

- Individuals will be able to onboard via a third-party integration with zkMe, providing ID and proof of address.

- Entities can contact Structured Business Team directly for manual verification.

While acquiring and trading maxBTC on DEXs will be possible without KYC, minting and redemption through Structured will always require verification to comply with AML standards.

For more details on KYC requirements and the verification process, please see our FAQ.

Building sustainable BTC yield

maxBTC concentrates liquidity in a single asset that can be deployed across scalable, market-neutral strategies. It allows holders to earn BTC-denominated returns while maintaining exposure to Bitcoin, and ensures that capital remains liquid and composable across DeFi integrations.

Through a partnership with Neutron, access now extends beyond the private beta. The vault gives eligible participants the ability to mint maxBTC, earn yield, and establish liquidity that enables DeFi use cases.

Visit structured.money/vaults to get started.

Stay up to date

- Join the Structured Announcements and Bitcoin Summer Announcements channels on Telegram

- Follow Structured on X and LinkedIn

- Read Structured’s Docs

- Visit Structured’s website

- Learn more about maxBTC Vaults and the Structured Points Program

About Structured

Structured is shaping a new standard for Bitcoin yield, turning BTC from a static store of value into a liquid asset that generates sustainable returns and unlocks broader financial utility. Its mission is to deliver real BTC yield that’s scalable, composable, and liquid by design.

The team draws on deep expertise from leading liquid staking protocols and institutional staking providers. We build on proven DeFi infrastructure to create yield solutions designed specifically for Bitcoin’s unique characteristics and structural realities.

During our contributors’ time at Lido (Ethereum’s leading liquid staking provider), P2P (an institutional staking provider), and Nomura (Japan’s largest investment bank and brokerage), we developed a deep, first-hand understanding of what it takes to make the largest crypto assets liquid, secure, and impactful within an open financial ecosystem.

DISCLAIMER: This content is strictly educational and not targeted at any individual or jurisdiction. It should not be construed as advice or a solicitation to acquire a specific asset. It is not financial advice, or advice of any nature. Crypto products (particularly those deployed via smart contracts and in a decentralized manner) are high-risk and you should not expect to be protected or have recourse if something goes wrong. Market conditions may change and actual future results may vary. Always DYOR and consult appropriate professionals.

Comments ()