maxBTC explained: JLP strategy

This article explains how maxBTC works in practice, introduces Structured’s first deployed strategy, and shows the performance so far.

Our previous article introduced maxBTC as a liquid, composable BTC asset designed to deliver sustainable yield. If you haven’t read it yet, start with Introducing maxBTC for the thesis and context.

This article is part two. It explains how maxBTC works in practice, introduces Structured’s first deployed strategy, and shows the performance observed so far.

One liquid asset, infinite strategies

maxBTC isn’t tied to a single chain or strategy. One token represents BTC yield across multiple sources, so liquidity concentrates, integrations stay simple, and scale becomes possible.

- BTC exposure with BTC-denominated yield: effectively 1× long BTC while compounding rewards

- Scalable across strategies: new sources of native BTC yield can be added without fragmenting liquidity

- Liquid and composable: built to integrate with DEXs, lending markets, and yield protocols

How maxBTC works

Users deposit BTC or a BTC wrapper to mint maxBTC. Holding maxBTC preserves BTC exposure while the protocol relies on multiple strategies to generate yield. A single minting contract distributes capital across strategies while keeping liquidity unified, creating strong network effects:

- DEX liquidity remains concentrated in one market

- Capital is allocated across strategies according to yield and risk

- Integrations with lending markets, yield aggregators, and DeFi protocols only need to support one asset

The result is an asset that compounds utility as it scales. maxBTC keeps BTC fully liquid while compounding yield in the background, similar to how wstETH works for Ethereum.

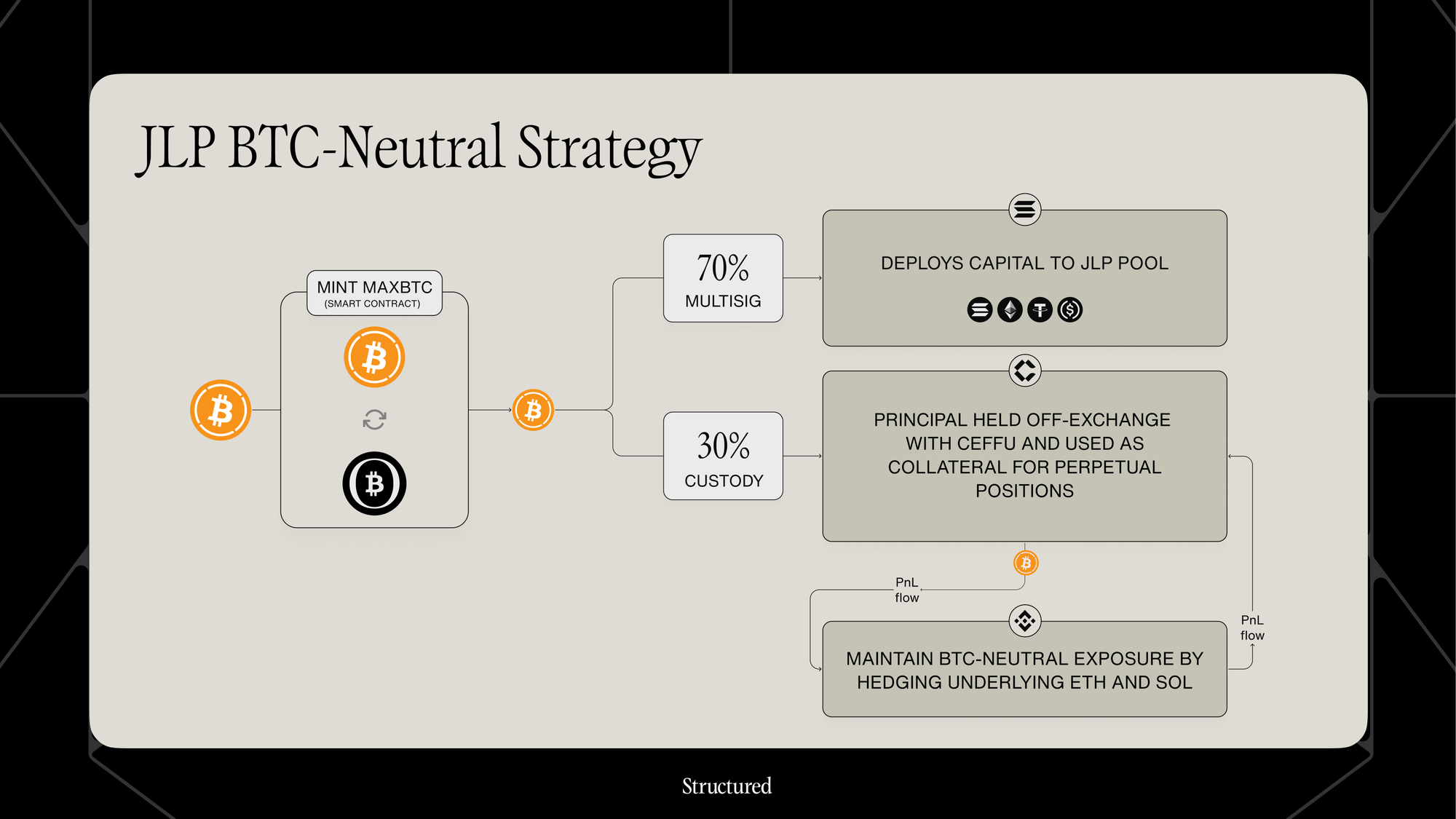

The JLP strategy: neutral yield from perpetual trading

The initial strategy underlying maxBTC is based on the Jupiter Liquidity Provider (JLP) pool, which backs leveraged positions on Jupiter Perps and earns fees from trader activity. Traders borrow from the pool to take leveraged positions, and JLP earns yield from their trading flows and fees. The pool itself is backed by an index of SOL, ETH, WBTC, USDC, and USDT, distributing 75% of collected fees to liquidity providers.

The strategy allocates capital across two legs: about 70% to JLP and 30% as collateral on Ceffu, an institutional custody platform, for hedging on Binance perps. The JLP side earns fees from trader activity, while the hedge neutralizes non-BTC exposure. Positions are rebalanced continuously to track pool composition and trader positioning, converting trading activity into BTC-denominated yield.

Yield sources

The JLP strategy generates yield from real market activity:

- Opening and closing fees on trades

- Borrowing fees paid by leveraged traders

- Protocol trading fees

- Liquidation fees

This is real BTC-denominated yield from flows that increase during volatility and reward efficient strategies.

Strategy capacity and performance

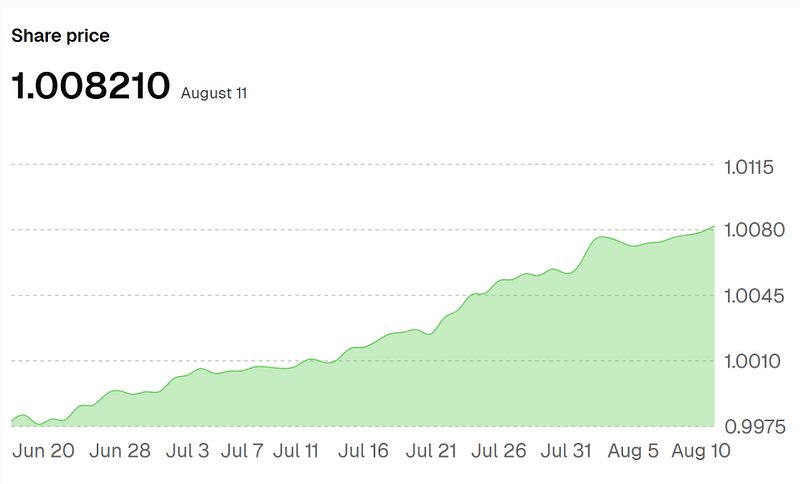

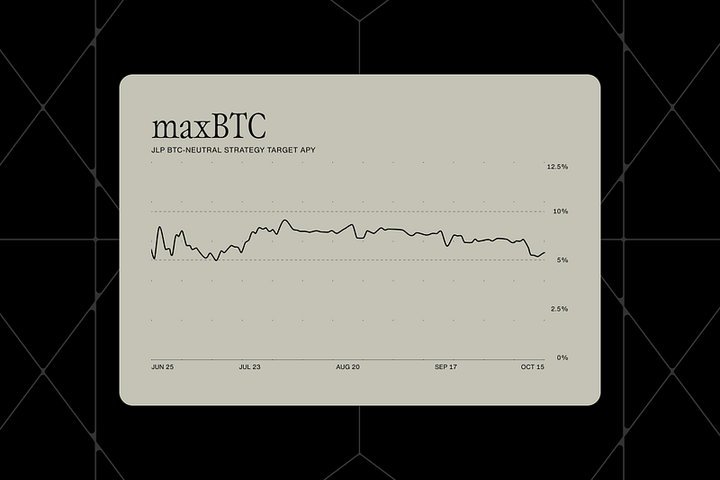

The JLP BTC neutral strategy has been live since December 2024. Since June 2025, Structured has deployed 50 BTC during a private beta with mainnet assets, generating 5–10% APY*. The strategy is currently designed to handle $1B+ in capacity while maintaining efficiency.

*APY and other performance figures are based on historical data which assumes no net stake/unstake activity during reward vesting periods and are for informational purposes only.

Strategy advantages

- Market-neutral design: neutralizes non-BTC exposure while preserving BTC alignment

- Sustainable source: yield comes from trading flows, not emissions or points

- Volatility capture: benefits from higher trading fees during volatile conditions

- Automated rebalancing: continuously adjusts hedge sizes to reflect JLP composition and trader positioning

What’s next

maxBTC will expand the range of strategies, onboard partners, and extend integrations across DeFi. Over time, users will also be able to access individual strategies directly, based on risk profile and custody preferences.

The next milestone is opening the current strategy to a broader set of users. Details will follow soon.

- Follow Structured on Twitter and LinkedIn

- Join the announcement channel on Telegram

- Get in touch with the team

About Structured

Structured is shaping a new standard for Bitcoin yield, turning BTC from a static store of value into a liquid asset that generates sustainable returns and unlocks broader financial utility. Its mission is to deliver real BTC yield that’s scalable, composable, and liquid by design.

The team draws on deep expertise from leading liquid staking protocols and institutional staking providers. We build on proven DeFi infrastructure to create yield solutions designed specifically for Bitcoin’s unique characteristics and structural realities.

During our contributors’ time at Lido (Ethereum’s leading liquid staking provider), P2P (an institutional staking provider), and Nomura (Japan’s largest investment bank and brokerage), we developed a deep, first-hand understanding of what it takes to make the largest crypto assets liquid, secure, and impactful within an open financial ecosystem.

DISCLAIMER: This content is strictly educational and not targeted at any individual or jurisdiction. It should not be construed as advice or a solicitation to acquire a specific asset. It is not financial advice, or advice of any nature. Crypto products (particularly those deployed in a decentralized manner) are high-risk and you should not expect to be protected or have recourse if something goes wrong. Market conditions may change and actual future results may vary. Always DYOR and consult appropriate professionals.

Comments ()