Introducing Structured Points

The Structured Points Program recognizes early participation across vaults and integrations.

Structured introduces the Structured Points Program alongside opening access to maxBTC as part of Neutron’s Bitcoin Summer campaign.

The Structured Points Program recognizes early participation across vaults and integrations. Points have been accruing from day one and are now fully visible on the live leaderboard, updated weekly.

Two maxBTC vaults are open for deposits on Neutron:

- Minting Vault: mint maxBTC and earn BTC-denominated yield

- Liquidity Vault: mint and provide liquidity in the maxBTC/WBTC Supervault for maxBTC exposure and market-making yield

Participants in either vault not only contribute to bootstrapping liquidity for maxBTC, but also earn Structured Points by default. Deposits are also eligible for NTRN rewards under Neutron’s Bitcoin Summer reward system.

Learn more about the maxBTC Minting and Liquidity vaults in this guide or visit the vaults page to get started.

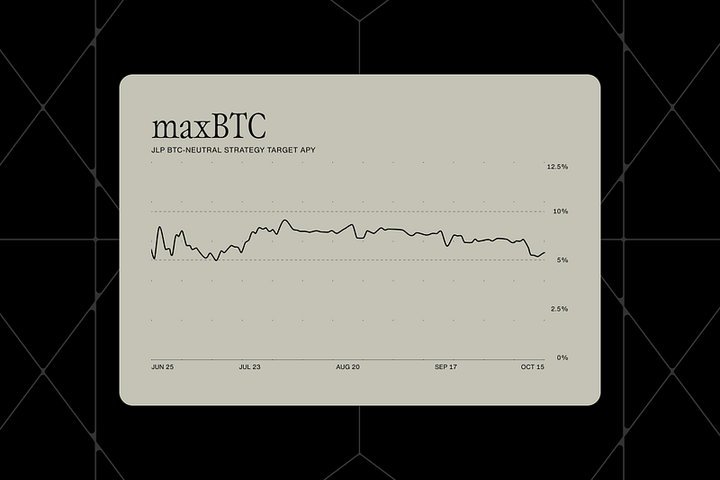

If you are new to maxBTC, read Introducing maxBTC: Real Yield on Bitcoin for the broader thesis and maxBTC Explained: JLP Strategy for the first deployed strategy.

What are Structured Points?

Structured Points are designed to measure and reward meaningful participation. Every deposit, liquidity position, and integration that strengthens maxBTC is recognized through points.

Points are separate from the BTC yield generated by maxBTC itself. While maxBTC generates BTC-denominated returns from real market strategies, Structured Points track activity and rewards those helping bootstrap liquidity.

Points accrue from day one and are updated weekly on the Structured Points leaderboard. Safeguards ensure fairness: thresholds prevent balance-splitting, referral rewards benefit the referred user directly, and mechanics are applied consistently across all participants. The program is designed to expand over time, with a tier system planned for later phases to recognize sustained engagement.

For more details, see the Structured Points FAQ and official docs.

Earn through participation

Structured Points are earned across vaults and integrations. Each action carries a multiplier that reflects its contribution to maxBTC liquidity and adoption.

Multipliers

1× | Base-level participation

- Deposit WBTC to mint maxBTC

- Hold maxBTC on Neutron (outside DeFi protocols)

2× | Use maxBTC as collateral in DeFi lending

- Use maxBTC as collateral on Amber Finance

5× | Depth for BTC pairs

These positions expand secondary markets for maxBTC across Supervaults and Astroport.

A) Lend + Supervault

Route BTC assets through lending integrations on Ethereum. The position is paired with maxBTC into the corresponding Supervault on Neutron, tying lending supply to trading liquidity.

- Bedrock Lend + maxBTC LP (uniBTC)

- Solv Lend + maxBTC LP (SolvBTC)

- Etherfi Lend + maxBTC LP (eBTC)

B) Direct Supervault LPs

Deposit maxBTC directly into Supervault pairs. These LPs enable market-making activity and connect maxBTC to BTC assets in active trading venues.

- maxBTC/uniBTC LP Supervault

- maxBTC/SolvBTC LP Supervault

- maxBTC/eBTC LP Supervault

- maxBTC/LBTC LP Supervault

C) Astroport pools

Provide liquidity to the same BTC pairs on Astroport. These pools expand secondary market depth for maxBTC.

- Astroport maxBTC/uniBTC LP

- Astroport maxBTC/SolvBTC LP

- Astroport maxBTC/eBTC LP

- Astroport maxBTC/LBTC LP

10× | Provide liquidity in WBTC pairs

Positions that concentrate depth in the core maxBTC/WBTC markets across Supervaults and Astroport.

- Liquidity Vault shares (mint + maxBTC/WBTC LP Supervault)

- maxBTC/WBTC LP Supervault

- Astroport WBTC/maxBTC LP

25× | Provide liquidity in stablecoin pairs

Positions connecting maxBTC to USDC build stable trading venues for converting between BTC yield and stable assets.

- maxBTC/USDC LP Supervault

- Astroport maxBTC/USDC LP

The Structured Points Program will continue to evolve as new strategies and integrations go live. Multipliers and supported positions may change over time, check structured.money/points for the latest information and to track your activity.

Stay up to date

- Join the Structured Announcements channel on Telegram

- Follow Structured on X and LinkedIn

- Read Structured’s Docs and FAQ

- Visit Structured’s website

- Visit the vaults page to deposit

- Explore the Structured Points Program

About Structured

Structured is shaping a new standard for Bitcoin yield, turning BTC from a static store of value into a liquid asset that generates sustainable returns and unlocks broader financial utility. Its mission is to deliver real BTC yield that’s scalable, composable, and liquid by design.

The team draws on deep expertise from leading liquid staking protocols and institutional staking providers. We build on proven DeFi infrastructure to create yield solutions designed specifically for Bitcoin’s unique characteristics and structural realities.

During our contributors’ time at Lido (Ethereum’s leading liquid staking provider), P2P (an institutional staking provider), and Nomura (Japan’s largest investment bank and brokerage), we developed a deep, first-hand understanding of what it takes to make the largest crypto assets liquid, secure, and impactful within an open financial ecosystem.

DISCLAIMER: This content is strictly educational and not targeted at any individual or jurisdiction. It should not be construed as advice or a solicitation to acquire a specific asset. It is not financial advice, or advice of any nature. Crypto products (particularly those deployed via smart contracts and in a decentralized manner) are high-risk and you should not expect to be protected or have recourse if something goes wrong. Market conditions may change and actual future results may vary. Always DYOR and consult appropriate professionals.

Comments ()