Introducing maxBTC: Real Yield on Bitcoin

Bitcoin has gained mainstream acceptance as an internet-native store of value. It now holds the potential to become the asset at the center…

Bitcoin has gained mainstream acceptance as an internet-native store of value. It now holds the potential to become the asset at the center of a new financial system, one that not only preserves wealth but also enables it to grow.

Just as global demand for USD-denominated returns scaled with the dollar’s adoption, so too has the appetite for Bitcoin-native alternatives. In the TradFi system, yield-bearing assets such as bonds represent about 6% of all dollars in circulation.

In Ethereum’s case, 15.6% of ETH supply is in yield-bearing form through liquid staking and liquid restaking tokens, while for Bitcoin the share is closer to 0.3%.

This gap is visible in lending markets. On Aave, less than 4% of supplied WBTC is borrowed, leaving nearly $5 billion underutilized, waiting for sustainable, liquid solutions.

The problem isn’t demand, but a lack of quality supply. Most Bitcoin yield products fall short: they are either illiquid and not composable, or unsustainable, driven by speculative points schemes and inflationary token rewards.

The solution is an asset that holds BTC’s core properties while enabling capital to move freely across DeFi.

Introducing maxBTC: Tokenized Yield on Bitcoin

maxBTC is liquid, yield-bearing Bitcoin that offers sustainable returns to its holders through proven BTC-denominated strategies.

Built for composability, its LST-like structure makes it compatible with existing DeFi integrations and effective as collateral in lending markets. It lets holders deploy capital without losing BTC exposure, improve capital efficiency, and scale with multiple underlying strategies over time.

Key features:

- Real BTC Yield: Attractive BTC-denominated yield from a portfolio of tested strategies, not emissions

- LST-like Form Factor: Composable design that enables users to leverage their BTC through DeFi integrations

- Liquid: Withdraw anytime or trade via DEXs with minimal slippage

- Transparent and Secure: Clear strategy mechanics and risk metrics

- Scalable: Supports multiple strategies without manual capital rotation

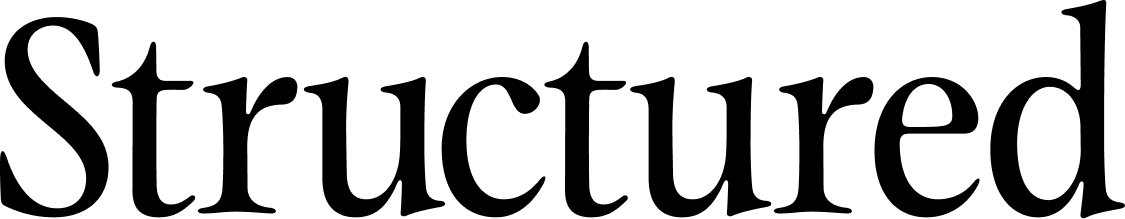

During a 50-day private beta testing period with mainnet assets, maxBTC generated 5–10% APY* with 50 BTC in deployed capital, with no points or token incentives. The underlying strategy itself has been running for over 240 days.

The design lets holders pick their own risk level, using it in DeFi strategies such as borrowing or leveraged looping to amplify returns.

maxBTC is currently undergoing audits and thorough testing. Private whitelisted participants include Monarq Asset Management, Ouroboros Capital, CoinFund team members, Ether.Fi contributors, and chefs from Steakhouse Financial.

*Performance figures are for estimation and informational purposes only, based on historical testing data.

Turning idle BTC into productive capital

Without a native yield source like USD Treasuries or Ethereum staking, billions in wrapped BTC sit unused in lending protocols with few sustainable deployment options.

Structured’s mission with maxBTC is to give Bitcoin holders a liquid, yield-bearing asset that integrates seamlessly across DeFi, delivering sustainable and scalable BTC-denominated returns.

Want to learn more about how maxBTC works and the first deployed strategy? Read maxBTC Explained: JLP Strategy.

Stay up to date

maxBTC is now in its final testing phase and will soon be available for broader use. Get updates through Structured’s official channels:

- Follow Structured on Twitter and LinkedIn

- Join the announcement channel on Telegram

- Get in touch with the team

About Structured

Structured is shaping a new standard for Bitcoin yield, turning BTC from a static store of value into a liquid asset that generates sustainable returns and unlocks broader financial utility. Its mission is to deliver real BTC yield that’s scalable, composable, and liquid by design.

The team draws on deep expertise from leading liquid staking protocols and institutional staking providers. We build on proven DeFi infrastructure to create yield solutions designed specifically for Bitcoin’s unique characteristics and structural realities.

During our contributors’ time at Lido (Ethereum’s leading liquid staking provider), P2P (an institutional staking provider), and Nomura (Japan’s largest investment bank and brokerage), we developed a deep, first-hand understanding of what it takes to make the largest crypto assets liquid, secure, and impactful within an open financial ecosystem.

DISCLAIMER: This content is strictly educational and not targeted at any individual or jurisdiction. It is not financial advice, or advice of any nature. Crypto products (particularly those deployed in a decentralized manner) are high-risk and you should not expect to be protected or have recourse if something goes wrong. Always DYOR and consult appropriate professionals.

Comments ()