How maxBTC performed during October 10 market volatility

October 10 brought a sharp market correction that triggered large-scale liquidations and stressed trading infrastructure across the…

October 10 brought a sharp market correction that triggered large-scale liquidations and stressed trading infrastructure across the industry.

At the same time, that volatility served as a live validation of maxBTC’s performance under stress. During the drawdown, the strategy captured liquidation fees that contributed positively to performance.

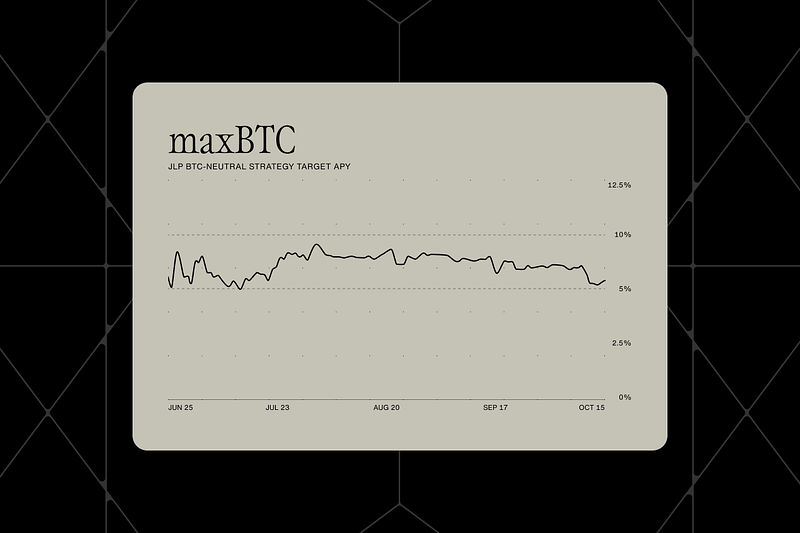

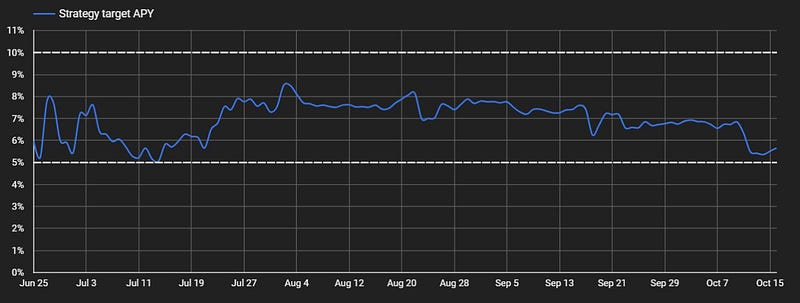

After the initial price drop, funding rates on SOL shifted significantly, causing a temporary net decrease of around 0.35% (about 20 days of performance). Despite short-term fluctuations, overall performance for private deposits remains well within the 5–10% APY target range.

JLP BTC-neutral strategy

JLP BTC Neutral is maxBTC’s first underlying strategy, is built on the Jupiter Liquidity Provider pool, which backs leveraged positions on Jupiter Perpetuals and earns fees from trader activity.

The pool is composed of SOL, ETH, WBTC, USDC, and USDT, distributing 75% of collected trading, borrowing, and liquidation fees to liquidity providers. Its market-neutral design hedges non-BTC exposure, allowing the strategy to stay balanced through periods of volatility.

Learn more about the JLP strategy in the Structured docs and in this article: maxBTC Explained: JLP Strategy.

Mechanisms that protect the strategy during volatility

The JLP strategy is designed to maintain delta-neutral exposure and stability across market conditions. Protection during volatility is achieved through three core mechanisms that balance positions and control risk.

1. Market-neutral exposure

Capital is deployed across two sides:

- A long position in the JLP pool, earning fees from trader activity on perpetual markets.

- Short positions in SOL and ETH perpetuals to offset non-BTC exposure from the JLP basket and maintain BTC denomination.

These positions balance each other, keeping the strategy market-neutral with delta hedging and minimizing directional price risk.

2. Continuous rebalancing

Hedge positions are rebalanced regularly to track JLP composition changes and trader activity. This maintains delta-neutral exposure and limits drawdowns during rapid market movements.

3. Real-time risk monitoring

Structured uses automated position monitoring and real-time collateral sufficiency checks, supported by redundant monitoring systems with global distribution.

Automated failover mechanisms, multi-signature authorization for critical operations, and regular infrastructure audits and testing ensure stability during periods of market stress.

The strategy continues to demonstrate resilience during extreme market conditions, with each event providing additional data and validation for performance and system design improvements over time.

Learn more about the risks and control mechanisms behind the JLP BTC-neutral strategy.

Follow Structured on Twitter and LinkedIn.

Join the announcement channel on Telegram or get in touch with the team.

About Structured

Structured is shaping a new standard for Bitcoin yield, turning BTC from a static store of value into a liquid asset that generates sustainable returns and unlocks broader financial utility. Its mission is to deliver real BTC yield that’s scalable, composable, and liquid by design.

The team draws on deep expertise from leading liquid staking protocols and institutional staking providers. We build on proven DeFi infrastructure to create yield solutions designed specifically for Bitcoin’s unique characteristics and structural realities.

During our contributors’ time at Lido (Ethereum’s leading liquid staking provider), P2P (an institutional staking provider), and Nomura (Japan’s largest investment bank and brokerage), we developed a deep, first-hand understanding of what it takes to make the largest crypto assets liquid, secure, and impactful within an open financial ecosystem.

DISCLAIMER: This content is strictly educational and not targeted at any individual or jurisdiction. It should not be construed as advice or a solicitation to acquire a specific asset. It is not financial advice, or advice of any nature. Crypto products (particularly those deployed in a decentralized manner) are high-risk and you should not expect to be protected or have recourse if something goes wrong. Market conditions may change and actual future results may vary. Always DYOR and consult appropriate professionals.

Comments ()